Overview of Fedwire

An introductory guide explaining Fedwire, how it functions, and key concepts for operating a wire integration.

Fedwire, formally known as the Federal Reserve Wire Network, is a real-time gross settlement network owned and operated by the 12 U.S. Federal Reserve Banks. It is the dominant high-value transfer mechanism in the US, handling trillions of dollars in transactions daily. Fedwire has two variants: Funds (for USD transfers) and Securities (for transfers of a limited group of securities).

Traditionally, wires have been labor intensive. There’s an assumption that there’ll be a manual exception process. As such, the messaging format allows a wide range of inputs to help wire desks properly allocate inbound wires. For example, a receiving account number isn’t strictly required by the specification. Normally this data is not visible to recipients. However, Increase exposes this raw data by default.

How Fedwire works

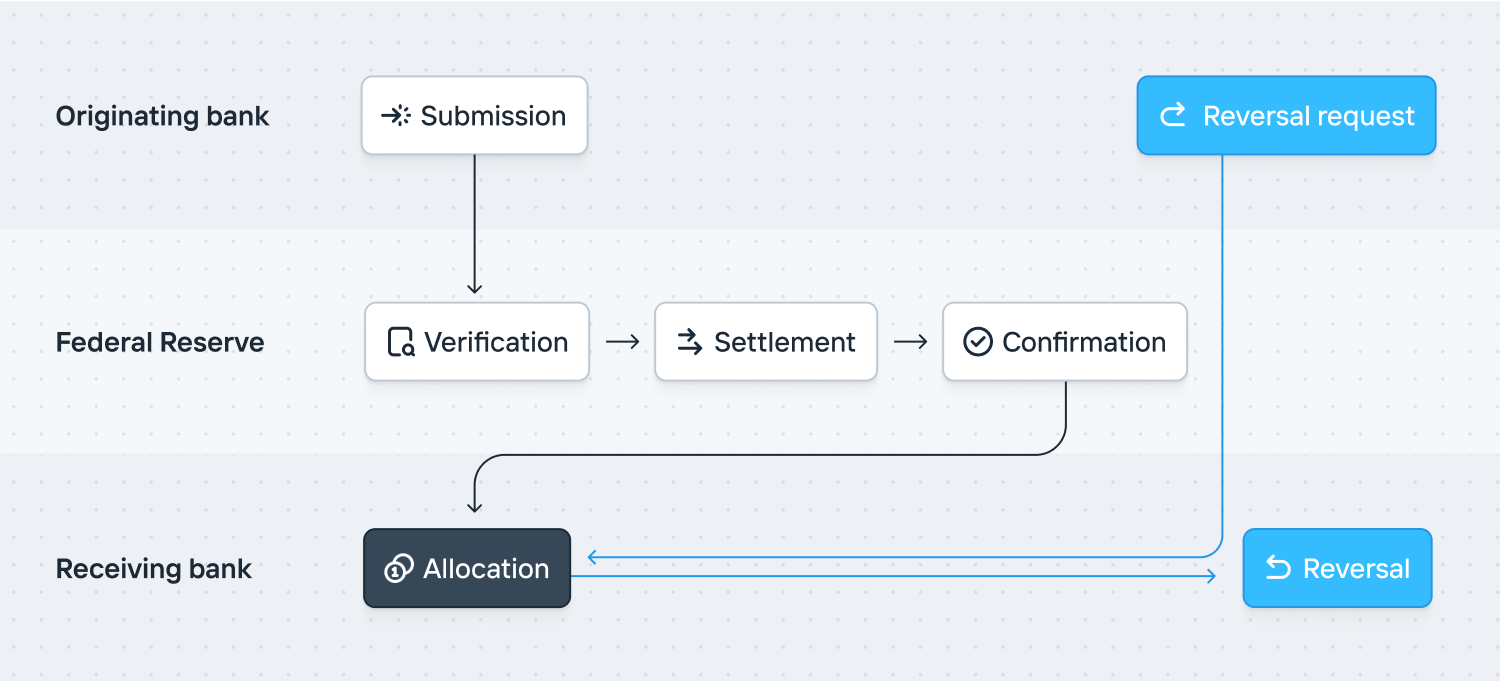

Fedwire is a ~synchronous network. The Federal Reserve — and in particular, the Federal Reserve Bank of New York — receives a wire and ~immediately debits the originating financial institution’s account and credits the receiving financial institution’s account. Here’s how it works:

Submission: A sender initiates a wire transfer with their institution. The institution debits funds from their account, and sends a payment order to a Federal Reserve Bank. The order includes the payment amount, the receiving institution’s details, and any additional instructions for reconciling the payment.

Verification: The Federal Reserve Bank verifies the payment order, ensuring the originating institution has sufficient funds to cover the transaction.

Settlement: Upon verification, the funds are deducted from the originating institution and credited to the receiving institution. This process occurs in real-time and on a transaction-by-transaction basis, ensuring immediate finality and irrevocability of payments.

Confirmation: Both the originating and receiving institutions receive confirmation of the completed transaction, typically within seconds or minutes.

Allocation: The receiving institution uses the provided instructions to reconcile the payment with the correct recipient. Funds are deposited into their account.

Reversal: If the receiving institution cannot properly reconcile the payment, it is reversed. A new wire transfer is created to send the funds back to the originating institution.

Reversals

Wire transfers are irrevocable. However, they can be reversed in a few instances. If a receiving financial institution cannot allocate or otherwise decides to not accept a transfer, it sends a reversal. Additionally, a sender can request that a wire is reversed. However, the receiving financial institution has no obligation to honor the request. Learn more about wire reversals and how they work with Increase.

Drawdown requests

Although Fedwire doesn’t support pulling funds, there’s a network-level primitive to request payment. This is called a drawdown request. There’s also a drawdown request payment network primitive which allows a transfer to be correlated with a drawdown request.

Support for drawdown requests is typically limited to corporate accounts and there’s usually setup required by the account holder. Common use-cases are for intra-company money movement or regular automated settlement. Settlement to Visa, for example, can be coordinated by drawdown request. If you wish to use drawdown requests, contact support@increase.com.

Non-financial messages

Fedwire supports a messaging network. It’s typically used for wire department to wire department communication. Because wire processing can still be very manual, the messaging network is often used to request additional information.

Timing

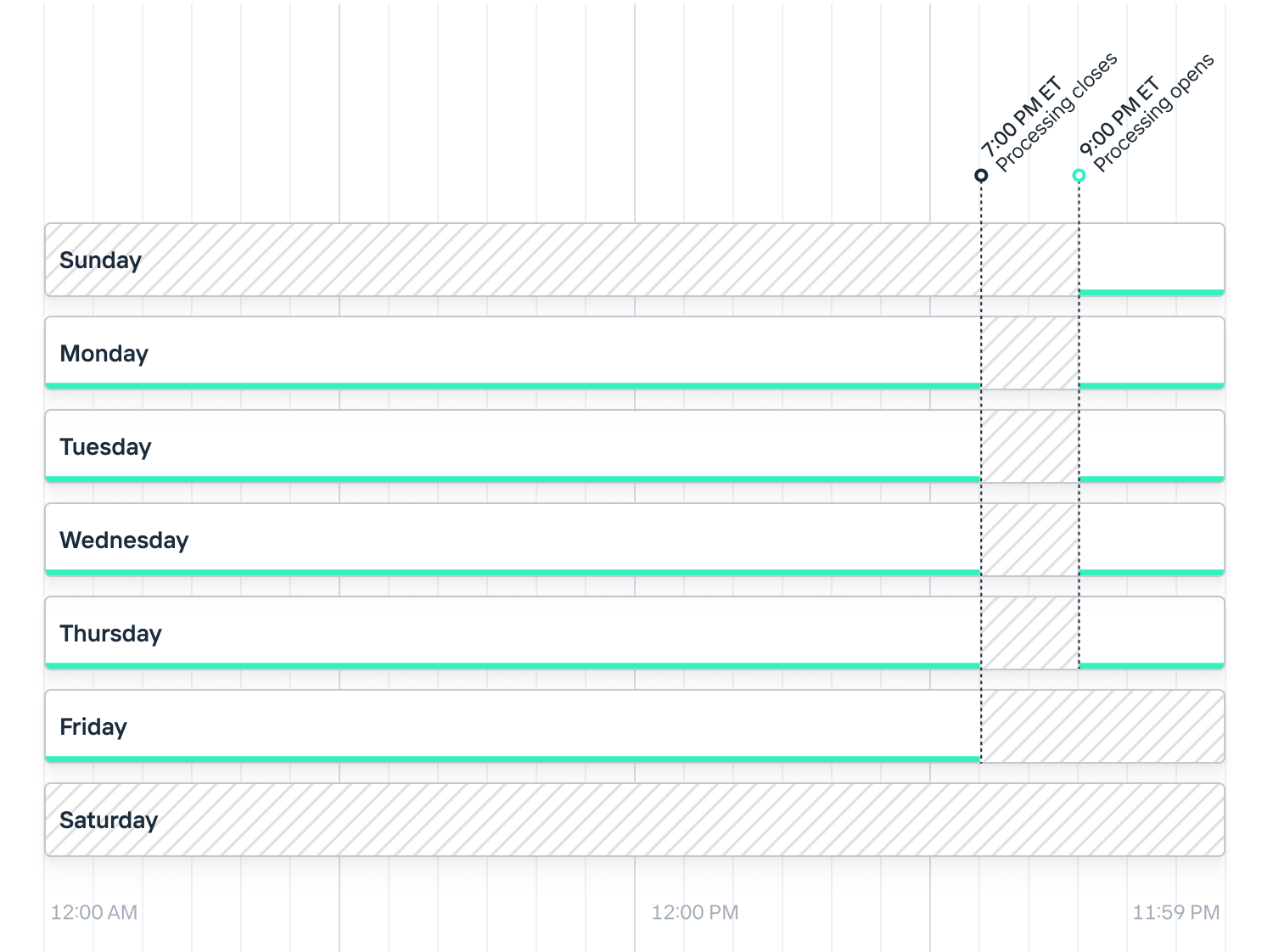

Fedwire operates according to a set schedule, opening at 9:00 PM ET on the preceding calendar day and closing at 7:00 PM ET. In practice, Fedwire can extend the operating hours. This typically happens in times of stress. Wires transfers are processed within the window that they’re submitted.

These times are subject to change, and different financial institutions may have their own cut-off times. Depending upon the bank you work with at Increase, wires may only be submitted within restricted hours. Also, keep in mind that holiday schedules could affect these times.

Operating a wire integration

One notable detail about wire operations is how manual they are at many institutions. Many financial institutions assume that wires will have manual intervention and therefore aren’t as strict as they might be with details like account numbers.

Fedwire can be used for settling USD legs of non-US transfers. Fedwire therefore supports passing through a SWIFT Business Identifier Code (BIC).