Positive pay

Overview

Positive pay is a feature built into every Check Transfer. When you create a Check Transfer, Increase records information about the payment. We use that information to reconcile incoming checks against pre-registered Check Transfers.

When a check is deposited at another financial institution, the depositing bank sends the following information to Increase via Check 21:

- The account number

- The check number

- The amount

- An image of the check

We automatically reject incoming checks that fail these validation steps:

- Do this check number and account number refer to a pre-registered check? Fraudsters will steal valid checks and create invalid duplicates by copying some, but not all, of the details.

- Does the amount presented match the pre-registered check? Your counterparty, or its bank, may have transcribed the check amount incorrectly. In that case, the check will be returned and they should re-deposit for the correct amount.

- Has the check already been successfully deposited? Fraudsters may find deposited checks (in the trash, on a desk in the office) and attempt to re-deposit it! Or, your counterparty may make a mistake and deposit it twice. In either case, you’re protected.

About 1% of incoming checks at Increase fail this validation, averaging $3,000 per check.

To help you and your customers monitor their accounts, all of the successful and unsuccessful deposits are available in the Dashboard and API. The Check Decline reason will indicate why our system returned a check deposit.

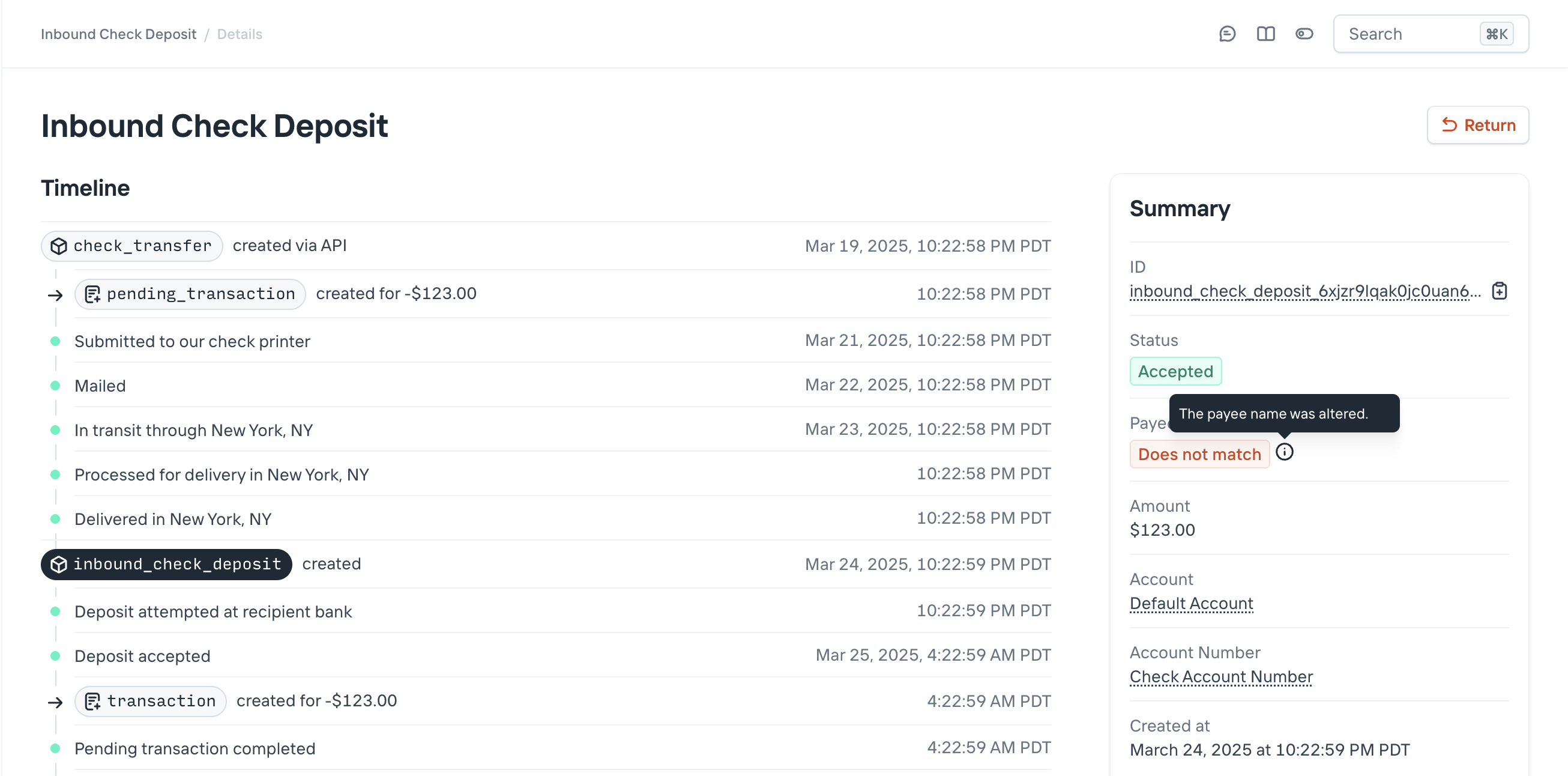

Payee name mismatches

Finally, checks can be altered and the “Pay To” line changed to a fraudster. Increase uses artificial intelligence to automatically identify checks that have been manipulated. We’ll flag checks with mismatched names to you in the Dashboard and API. In the API, the field Inbound Check Deposit payee_name_analysis determines whether or not the check matches what was recorded.

Your team should review the very small number of checks Increase identifies as does_not_match. We’ve found that our AI algorithm does not have the context on your customers to identify what is fraud and what is expected user behavior. You should make the ultimate determination. For some customers, more than half of the altered checks are actually deposited by the intended recipient. For example:

- A check written to

Ian Crease Accounting Servicesaltered toIan Crease. - A check written to

Crease Investment Fund Series 7deposited toCrease Investments. - A check written to

Alexander Grahamedited toAlexander Graham Bell.

Even when flagging seemingly obvious fraud like a line being changed from ABC Consulting Services to Eve Evilson, we prefer you to make the decision to return the check. Increase does not have the context on whether Eve is (for example) a sole proprietor doing business as ABC Consulting.

For most customers, a mismatch requiring investigation happens far fewer than 1 in 5000 checks.

Handling mismatches

When a Check Transfer is flagged as a name mismatch, you’ll get a Webhook of type inbound_check_deposit.created. You can use this indicator to trigger an alert on your end.

From there, your team can review the deposited check in the dashboard and compare it to the check you issued. You can also research the counterparty. If you want to return the check, you’ll need to decide within 7 days. You can return a check in the Dashboard or setup your internal tools to call the appropriate API endpoint.

If you want to honor the check, no action is required.

In the dashboard, you have access to all the relevant data: the original, printed pay-to name, the incoming check scan from the depositing bank, and a button to return the check if you determine it’s fraudulent.