Transactions and Transfers

Our APIs separate the concepts of Transactions and Transfers. This guide will help you understand their distinctions and how to use them successfully.

Transactions are immutable records of financial interactions with Increase. You can think of them as the line items on your bank statement. A Transaction with a positive amount means there’s more money in your account. A Transaction with a negative amount means there’s less money in your account. You can’t directly create a Transaction, and they never change after they are made. Anything that causes money to move around your Increase account results in a Transaction - initiated or received transfers, card payments, earned interest, and more.

Transfers- which includes ACH Transfers, Wire Transfers, etc - are the most common way to initiate money movement over external networks with Increase. Transfers are one-to-many with Transactions, which they create as side-effects. Unlike Transactions, Transfers are stateful and transition through a lifecycle of different statuses as they move across the network.

Pending Transactions represent potential future credits or debits of money into your account and are a separate resource from Transactions (despite their similar name). Notably, while Transactions are immutable, Pending Transactions are not, as they don’t guarantee the movement of money. For example, Pending Transactions are created for card authorizations (which can mutate or timeout) and also when placing a hold on an account (which can be removed). Pending Transactions do not affect your current balance (which is the balance you earn interest on), but do affect your available balance (which is the amount you’re able to move out of Increase).

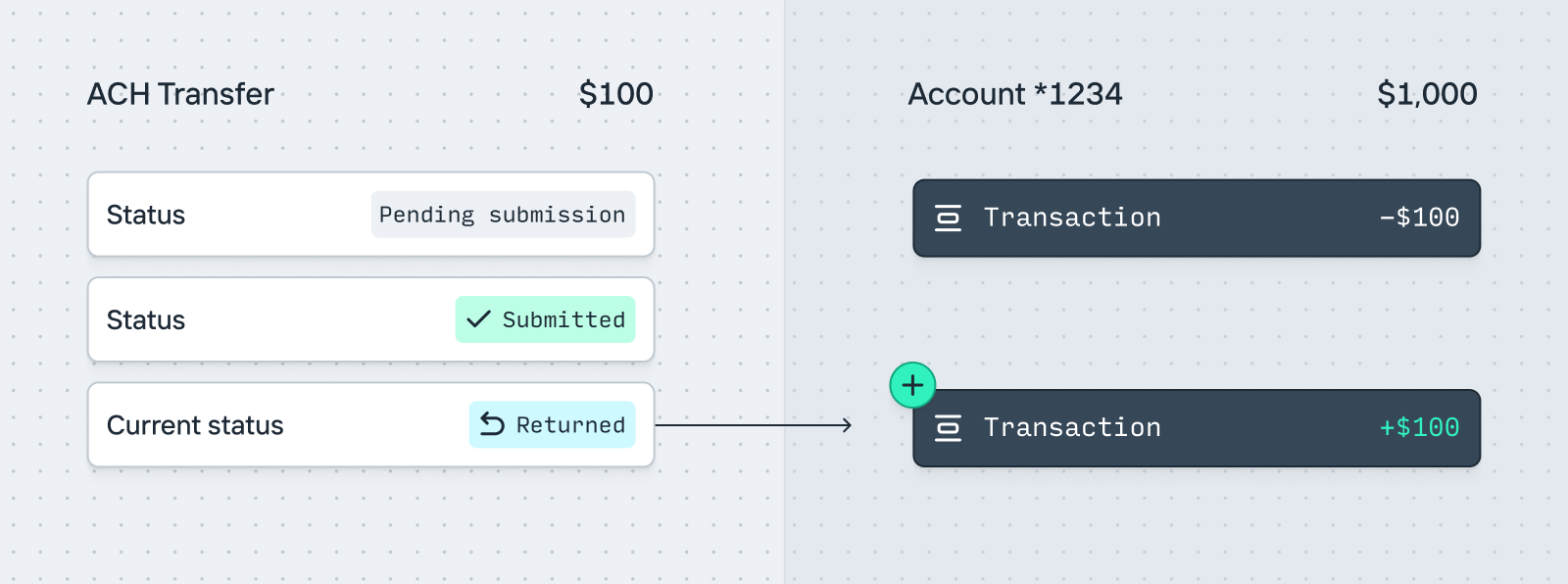

Example: Creating an ACH Transfer

Let’s examine the lifecycle of a hypothetical ACH Transfer.

T0: 9am ET on a Monday morning

- You start with $500 in your Increase account. (Your current balance and available balance are both $500.)

- You make an ACH Transfer (via the API or Dashboard) to pay a vendor $100.

- As a side effect, this immediately creates a -$100 Pending Transaction (you now have $100 less that you can move out of Increase). Your available balance is now $400.

- However, given ACH Transfers are submitted asynchronously and no money has actually moved yet at the Federal Reserve, no Transaction has been created yet. Your current balance is still $500 (you are earning interest on $500).

- The ACH Transfer has a status of

pending_submission.

T1: 9:30am

- A few minutes later, Increase submits the ACH Transfer to the Federal Reserve and changes its status to

submitted. Nothing else changes.

T2: 1:00pm

- At 1pm ET, per the Federal Reserve’s processing schedule, the transferred funds have settled at the receiving bank. As a result, Increase performs 2 updates simultaneously:

- The Pending Transaction updates to status:

complete, meaning the held funds are released. - A Transaction is created to reflect that the funds have left your Account.

- At this point, both your available balance and current balance are $400.

T3: 9am ET the following day

Now let’s say that unfortunately you entered the wrong account number for the vendor. The next day, the receiving bank recognizes the error and returns the ACH Transfer, which means we give you your $100 back.

- The ACH Transfer transitions to status

returned. - We make a second Transaction for +$100 to indicate that you now have 100 additional dollars.

- At this point your available balance and current balance are again both $500.

This flow demonstrates the one-to-many relationship between Transfers and Transactions. While one ACH Transfer object exists through this entire flow, At T0 there were zero Transactions created, at T2 there was one Transaction, and at T3 a second Transaction was created, all pointing to the same ACH Transfer.

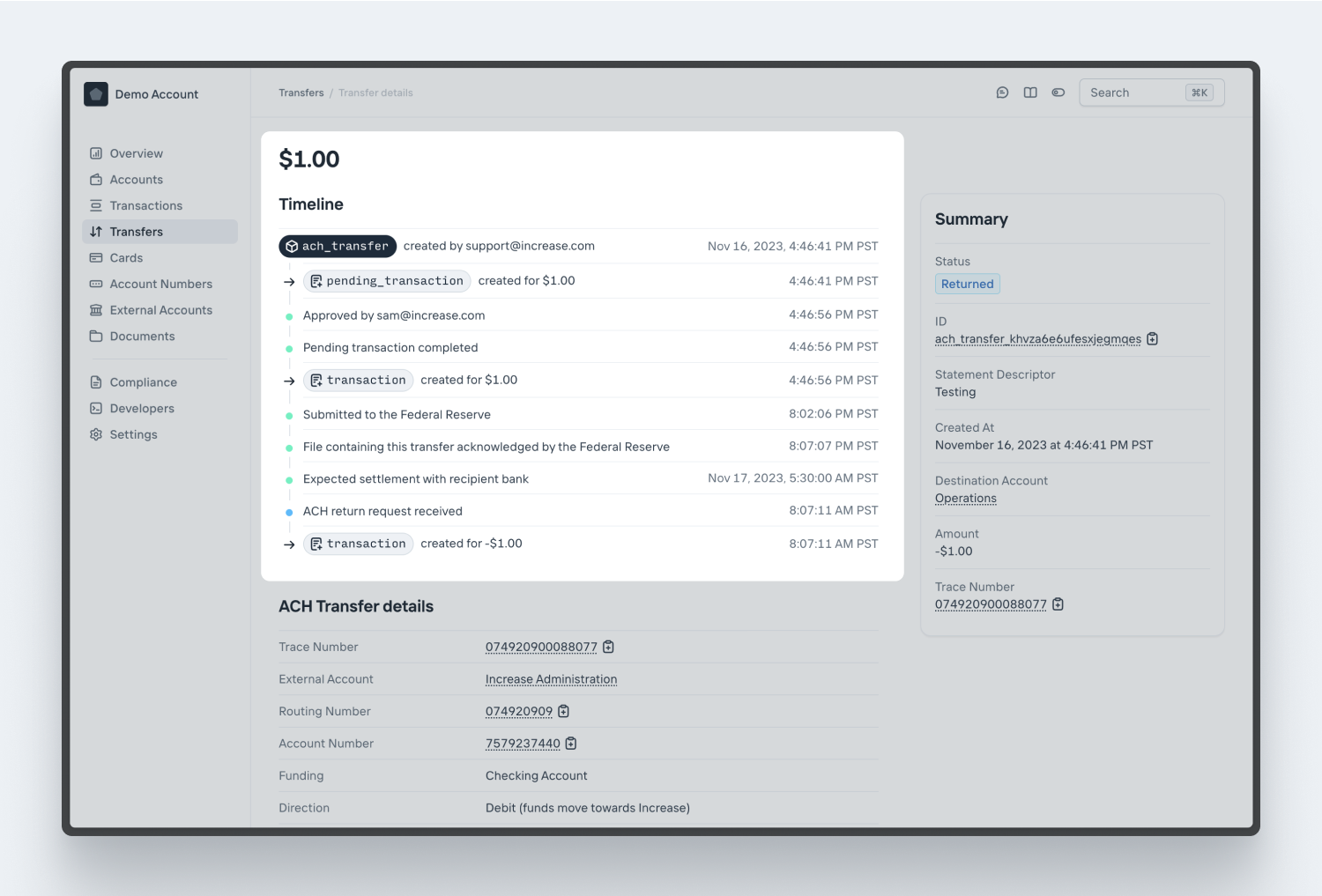

Dashboard

In your dashboard, you’ll be able to see the relationship between a Transfer and all of its Transactions and Pending Transactions as a timeline.