Article

Embedding financial services in vertical software

Matt Hennessy

Sales

Embedding financial services in industry-specialized software is good for customers, good for software companies, and good for banks. But to do it well, you need direct access to banking fundamentals and a willingness to understand how money actually moves.

Vertical software as the new distribution model

Traditionally, banks have specialized by geography. A community bank knows and understands its local customers deeply. But geography isn’t always the right proxy for customer needs. A dentist in Portland, OR has more in common with a dentist in Portland, ME than with a dry cleaner next door.

Industry specialization has always existed in banking. J.P. Morgan financed railroads. GMAC was created to finance the auto industry. What’s different now is that specialization increasingly comes from software, not banks. Vertical software platforms run tailored workflows for specific industries: dentists, insurance agents, contractors, nonprofits. And because those workflows often involve money, software platforms are naturally expanding into payments, bank accounts, lending, and more.

Think of a software platform for beauty businesses that not only manages appointment booking, but also handles embedded payroll and tailored loans for salons and spas. Or insurance software that started with accounting flows, and now handles client invoice payments and payouts to carriers.

Why payments literacy matters

Can a software company really be expected to understand banking? At Increase, we think yes.

Not everyone on your team needs to be a payments expert, but someone should be. Just as pizza software like Slice needs someone who understands oven throughput, vertical software teams embedding payments need someone who understands settlement timing, reconciliation, and network behavior. Your product will be stronger for it.

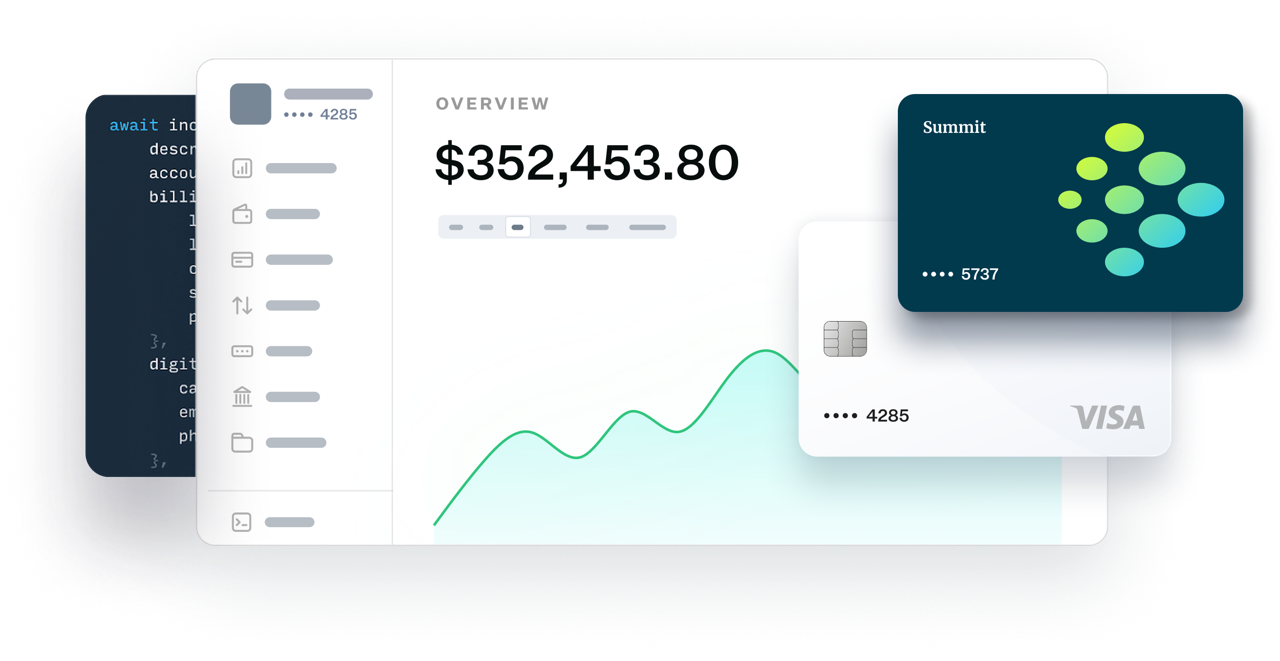

The good news: the lift to access and understand payment details isn’t as heavy as it once was. With Increase, those details are exposed directly to you, rather than being hidden behind layers of middleware. Our direct connections to the Federal Reserve, Visa, and The Clearing House make financial primitives programmatically accessible. You can test, monitor, and refine payments flows just like any other system that matters to your business.

Building on financial primitives

Embedded finance starts with financial primitives: accounts, payments, lending. They’re the building blocks. What matters is assembling them for the unique needs of your industry. For example:

- A property management platform building on Increase can debit rent through same-day ACH in the morning, see funds settle midday, and pay contractors seconds later via Real-Time Payment.

- A nonprofit software platform can assign every inbound donation its own Account Number, reconciling funds automatically down to the penny.

- An agriculture software provider can programmatically send paper checks and expose each lifecycle event — printed, mailed, deposited — giving farmers the transparency they expect. With direct, low-level access, the financial system becomes flexible enough to map to the workflows you already run.

Better outcomes with no abstractions

Embedding financial services inside vertical software creates better outcomes across the board. Customers get integrated, reliable workflows. Software companies unlock new revenue streams and deeper retention. And banks gain distribution into industries that would otherwise remain fragmented or underserved.

If you’re a vertical software platform launching embedded payments or financial services, you might be tempted by abstractions that hide complexity. But we’ve seen again and again that real speed, flexibility, and reliability come from building on financial primitives with no abstractions.

That’s the work we’re doing at Increase: giving vertical software platforms the modern banking core they need to build financial services that are seamless, resilient, and built for the industries they serve.

If you’re building in this space, let’s talk! Reach us at hello@increase.com.

Matt Hennessy

Sales

Increase is not a bank. Banking products and services are offered by Grasshopper Bank, N.A., Member FDIC, First Internet Bank of Indiana, Member FDIC, and Core Bank, Member FDIC. Cards Issued by First Internet Bank of Indiana, pursuant to a license from Visa Inc. Deposits are insured by the FDIC up to the maximum allowed by law through Grasshopper Bank, N.A., Member FDIC, First Internet Bank of Indiana, Member FDIC, and Core Bank, Member FDIC. FDIC deposit insurance only covers the failure of the FDIC insured bank.