Transparent reversals

Receive webhooks for every reversed wire transfer.

Flexible account numbers

Attribute every inbound payment to a unique account number.

Approval flows

Optional approval flows add an extra layer of security.

Limits

Programmable limits help prevent unintentional or unauthorized transfers.

Built for automation

Automate your wire desk

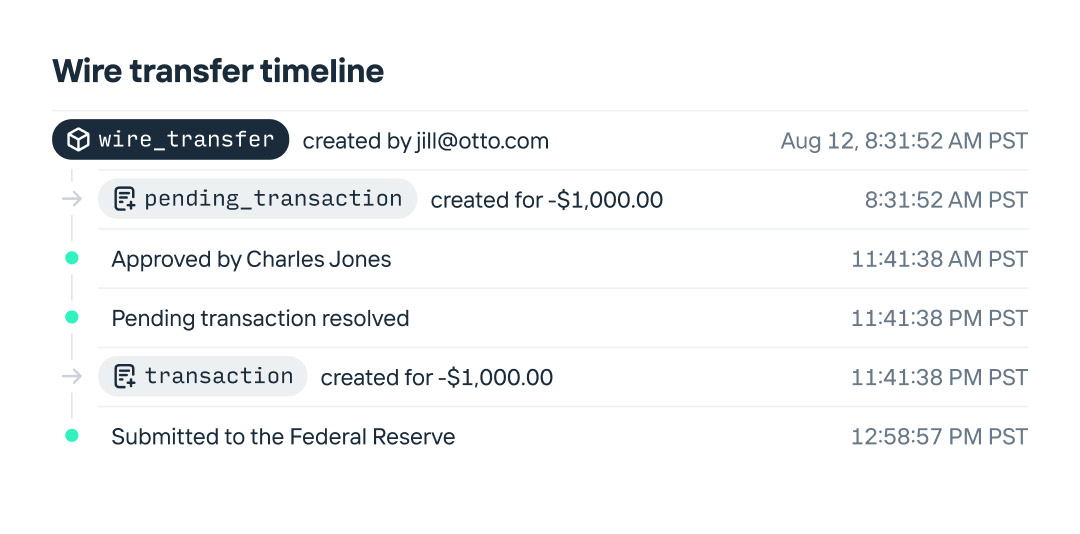

Programmatically send and receive wires with a single API call. Easily track the full lifecycle of a wire, respond to reversals, and access raw network details.

Track precise submission timing

Fine-grained reversal details

Create unique account numbers per sender

Full control

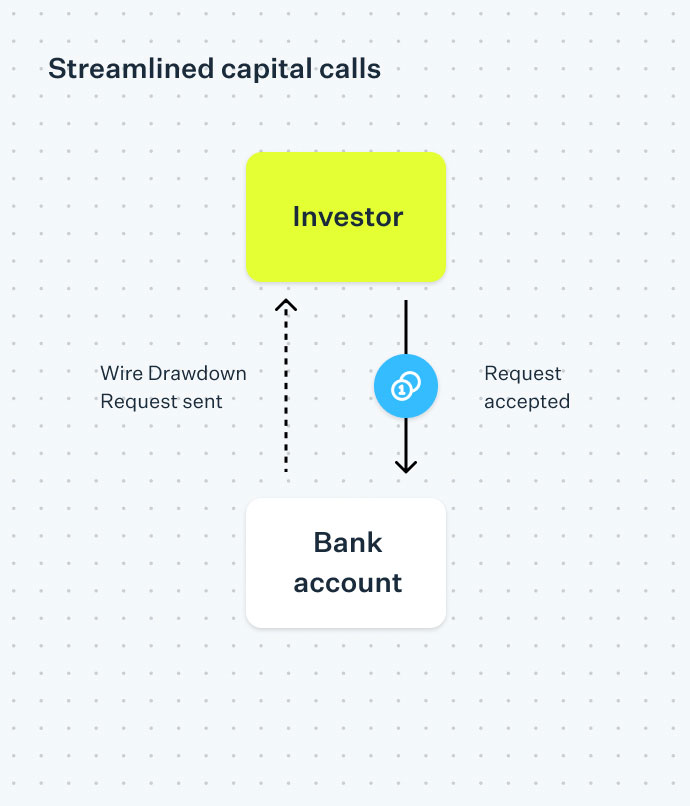

Send and receive drawdown requests

Send payment requests to third parties to safely and efficiently fund an account.

Wire drawdown requests are especially useful for investment platforms because they streamline capital calls by ensuring counterparties have the correct details ahead of time.

Instantly fund your accounts

Create tighter cashflow management

Reduce transfer errors

IMAD is instantly available

submissionImmediately send confirmation of a payment to the recipient.

Full reversal details

reversalAccess the specific reason why a transfer was returned from a wire desk.

Submission timing

submitted_atKnow when a wire is submitted to the Federal Reserve.

Banking for builders

ACH Payments

Originate ACH credits and debits, validate account numbers with pre-notifications and store commonly accessed details.

Learn more

Bank Accounts

Flexible account constructs with unlimited account numbers.

Learn more

Cards

Issue custom cards to your customers. Approve authorizations in real-time and configure your own limits.

Learn more

Checks

Send branded checks anywhere in the world with one API call. Or deposit checks via API or the dashboard.

Learn more

Wires

The original instantaneous money transfer. Send money anywhere, anytime Fedwire is open.

Learn more

Real-Time Payments

Transmit money to accounts at most major banks in seconds, not days.

Learn more

FedNow

The Federal Reserve’s newest payment method. Quickly move money 24/7/365 with any participating bank.

Learn more

Push-to-Card

Send funds to eligible Visa and Mastercard cards in seconds at any time.

Learn more

Increase is not a bank. Banking products and services are offered by Grasshopper Bank, N.A., Member FDIC, First Internet Bank of Indiana, Member FDIC, and Core Bank, Member FDIC. Cards Issued by First Internet Bank of Indiana, pursuant to a license from Visa Inc. Deposits are insured by the FDIC up to the maximum allowed by law through Grasshopper Bank, N.A., Member FDIC, First Internet Bank of Indiana, Member FDIC, and Core Bank, Member FDIC. FDIC deposit insurance only covers the failure of the FDIC insured bank.