Always available

Send money outside of banking hours, on weekends, and during public holidays.

No clawbacks

Payments are sent as credits so there are no returns or reversals.

Payment requests

Send a request for payment directly to a customer’s banking app.

Growing support

Reach two thirds of U.S. checking accounts.

Flexible and reliable

When every millisecond counts

Real-Time Payments are faster than ACH transfers and more available than wire transfers. With round-the-clock settlement, Real-Time Payments are the perfect tool to power flows that need off hours settlement or instant verification.

Use cases

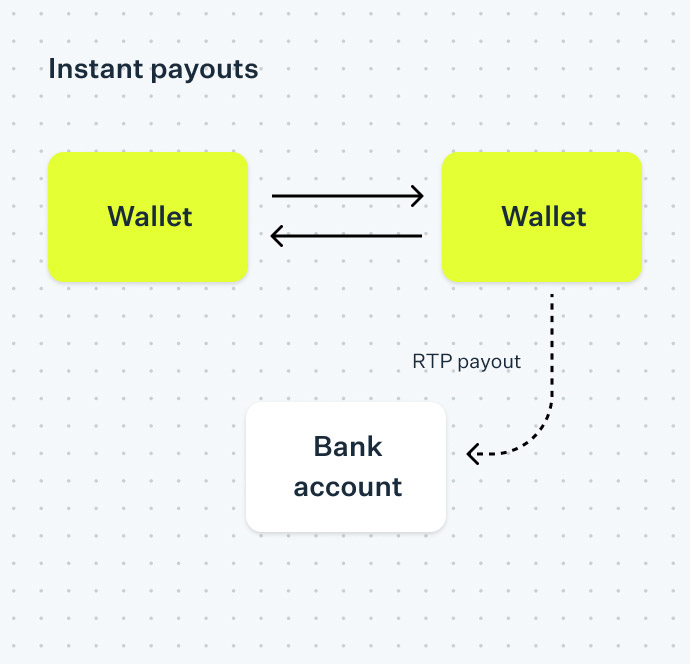

Digital wallets

Instantly pay out or top-up digital wallets from external bank accounts.

Auto sales

Complete auto purchases on weekends and outside of bank operating hours.

Contractor payments

Pay contractors within minutes of completing their work.

Reimbursements

Reimburse employees in real-time for company expenses.

Raw rejection details

rejectionInstantly receive detailed rejection codes and notes to help you understand the specific reason for a failed payment.

Transaction identification

transaction_identificationImmediately receive a unique transfer identifier from the RTP network to confirm a payment was sent.

Source account number

debtor_account_numberInstantly verify the account ownership of a third party by checking the account number in a received RTP.

Banking for builders

ACH Payments

Originate ACH credits and debits, validate account numbers with pre-notifications and store commonly accessed details.

Learn more

Bank Accounts

Flexible account constructs with unlimited account numbers.

Learn more

Cards

Issue custom cards to your customers. Approve authorizations in real-time and configure your own limits.

Learn more

Checks

Send branded checks anywhere in the world with one API call. Or deposit checks via API or the dashboard.

Learn more

Wires

The original instantaneous money transfer. Send money anywhere, anytime Fedwire is open.

Learn more

Real-Time Payments

Transmit money to accounts at most major banks in seconds, not days.

Learn more

FedNow

The Federal Reserve’s newest payment method. Quickly move money 24/7/365 with any participating bank.

Learn more

Push-to-Card

Send funds to eligible Visa and Mastercard cards in seconds at any time.

Learn more

Increase is not a bank. Banking products and services are offered by Grasshopper Bank, N.A., Member FDIC, First Internet Bank of Indiana, Member FDIC, and Core Bank, Member FDIC. Cards Issued by First Internet Bank of Indiana, pursuant to a license from Visa Inc. Deposits are insured by the FDIC up to the maximum allowed by law through Grasshopper Bank, N.A., Member FDIC, First Internet Bank of Indiana, Member FDIC, and Core Bank, Member FDIC. FDIC deposit insurance only covers the failure of the FDIC insured bank.