How to build a bill pay program with Increase

Every year, platforms like Ramp use Increase to move tens of billions of dollars through bill pay flows, making it one of the most common use cases we support. In this guide, we’ll walk through the high level of what building a bill pay program consists of. Increase offers low-level APIs to access payment networks in the US, following a principle we call “no abstractions”. As a result, there are often several ways to build a particular flow of funds with us. This article suggests best practices, but there are places where you’ll want to think about what’s best for your business—we’ll highlight some of these decision points below.

Onboarding your platform to Increase

Program setup

Every platform begins with a Program. This is where Increase and our bank partners work with you to define what your money movement product will do—what kinds of accounts you need, what rails you’ll move money over, and how the underlying bank will treat your business. This includes Increase performing Know Your Business (KYB) checks on your company. Learn more about platform onboarding

There’s often a few weeks of contracting at the beginning of an integration. During that time, you can build and test your integration using our sandbox environment, or in production using your own corporate funds to see how money actually moves. This lets you make technical progress in parallel, and can significantly shorten the time to launch.

Opening accounts

Typically, we recommend creating individual bank accounts for each of your customers. This avoids the need to build and maintain your own ledger, simplifies ownership, and gives you maximum flexibility. Account creation is synchronous and unbounded—you can create as many as you need. You can also assign each account unique account numbers for easier tracking of inbound transfers. Most platforms validate external bank accounts via Plaid or microdeposits.

Increase also supports commingled For Benefit Of (FBO) accounts if that’s a requirement for your business. You’ll need to integrate with our Bookkeeping API to ledger funds as they move through Increase.

Learn more about account structures

Onboarding your users

Know Your Customer (KYC)

You must operate a KYC program. Increase provides primitives, not policies, and as such you are responsible for fraud and risk controls. Most platforms use a third-party provider like Alloy, and integrate directly with Increase to automatically ingest those results.

Learn more about KYC requirements

Creating entities

Once you’ve verified your customer, you’ll create an Entity in Increase to represent them. This can be a business or an individual. This is a prerequisite to account creation. You can do this using the Create Entity API.

Collecting bank account details

If users will fund payments from their own bank accounts, you’ll need to collect account and routing numbers. Many platforms use Plaid or similar providers to validate account ownership and reduce issues during onboarding.

Creating accounts

After onboarding the Entity, create an account for the customer in Increase.

Initiating payments

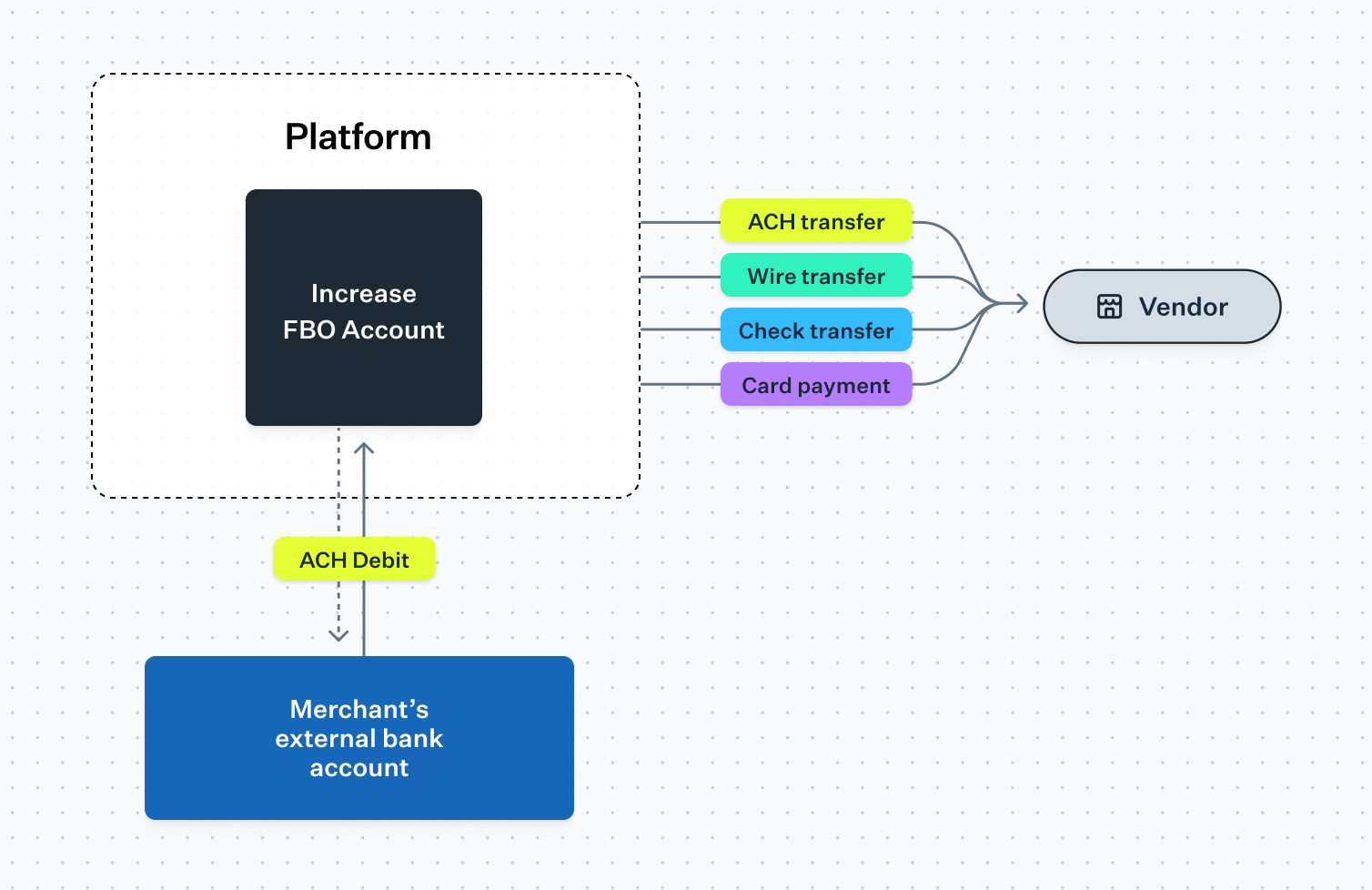

Most bill pay use-cases contain the same basic funds flow: fund the bill payment (typically from the customer’s external bank account) and then disburse it into the payee’s account.

Fund the bill payment

Most platforms use ACH debits to pull funds from customer bank accounts. With Increase this is a single API call to the Create ACH Transfer API. This works well but comes with the risk of returns—for example, due to insufficient funds or revocation. When a return happens, we recommend monitoring it via our API and notifying your operations team. Our API surfaces return codes that can help you investigate. You’ll decide how to handle those cases in your product experience.

If you want to avoid returns entirely, you can ask users to push funds in via ACH credit or wire. This slows things down but reduces operational risk.

Learn more about FedACH returns

Most platforms start by funding bill payments via the customer’s external account, but some platforms issue fully-featured bank accounts via Increase from which they directly initiate payments. This can speed up money movement, reduce costs, and create opportunities to monetize funds held on-platform.

Learn more about creating bank accounts for your customers

Disburse the bill payment

Increase can push funds over every major payment rail in the US, including ACH (same-day or next-day), wires, checks, Real-Time Payments (RTP), and Visa Direct. While ACH is the standard rail for most payments companies, your choice of payout rail may vary depending on your industry and the needs of your vendors or customers. You can fund and disburse the bill payment on different rails.

Some platforms allow the payor or the payee to select a faster option in exchange for a fee. For example, you might use RTP or wire transfers (which settle in seconds) instead of ACH, or send a check via FedEx instead of first-class mail.

As in the previous section, initiating most payments on Increase is a single API call, such as:

- Create an ACH Transfer

- Create a Check Transfer

- Create a Wire Transfer

- Create a Real-Time Payments Transfer

- Create a Card Push Transfer

For platforms looking to deepen their suite of financial services, you can also issue cards as part of your bill pay solution.

Learn more about building a card issuing program on Increase

While many options exist, payment initiation often reduces down to a few API calls with Increase. You can see this in action with our Postman collection for bill payments.

This guide is a broad overview. The specifics of your bill pay product will depend on what you’re building and who you’re serving. If you have questions, please reach out to support@increase.com - we’d be excited to talk to you!